The article titled “BTC Price Breakout by End of August? 5 Things to Know in Bitcoin This Week” provides an analysis of the current state of Bitcoin and offers insights into the potential breakout of its price by the end of August. Despite the lack of volatility in recent weeks, Bitcoin’s price forecasts suggest that a breakout may be imminent. The article highlights the accumulation of whales, the narrowing volatility depicted by Bollinger Bands, and the historical patterns indicating that a significant move may be on the horizon. Additionally, it mentions the Federal Reserve’s upcoming meeting minutes and their potential impact on the cryptocurrency market. With in-depth analysis and expert opinions, this article provides valuable insights for Bitcoin investors and enthusiasts.

Bitcoin copycat move begins new rangebound week

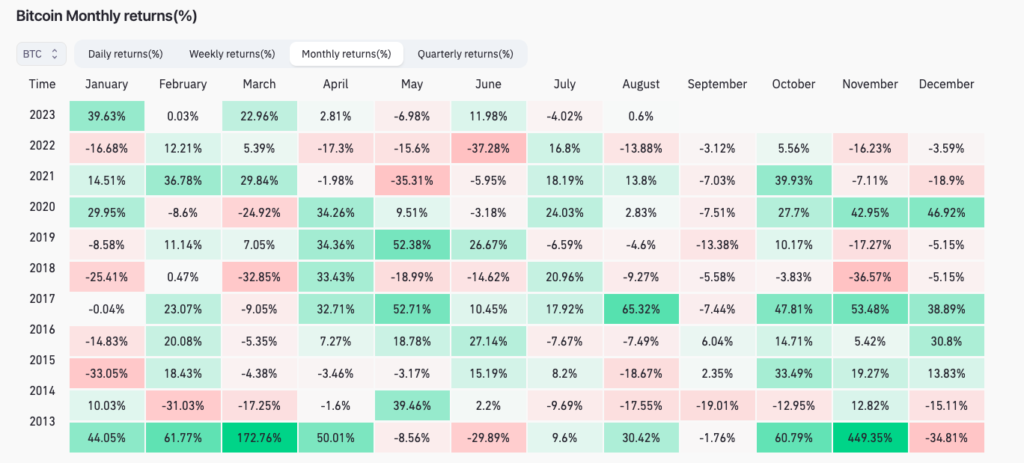

The weekly close saw a modicum of volatility return to Bitcoin spot price performance, but just like last week, this was short-lived. Following the new weekly candle open, BTC/USD dipped to test $29,000 before returning to its previous position — one that still holds at the time of writing. Traders and analysts have noted the similarities to previous price action and continue to watch the $29,700 level for a potential breakout. Despite the lack of volatility, there is a growing narrative that whales are accumulating Bitcoin, fueling speculation that a major breakout phase is imminent.

Low volatility spurs BTC price breakout predictions

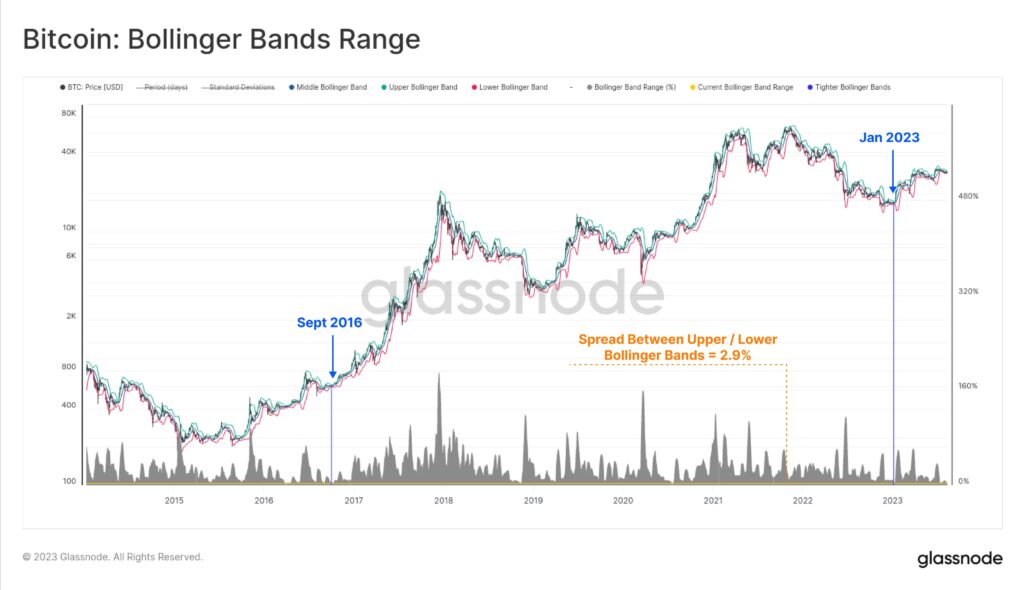

Bitcoin’s lack of volatility has become a major topic of discussion, not only within the crypto community but also among mainstream financial observers. The Bitcoin Historical Volatility Index (BVOL) currently measures 9.57 on weekly timeframes, rapidly retracing to all-time lows from the start of this year. Market participants are closely watching the Bollinger Bands, a volatility indicator, as the narrowing spread between the upper and lower bands suggests that a price breakout is on the horizon. The extent of price compression has led many to prepare for a dramatic change in the Bitcoin market.

Whale “reaccumulation” narrative strengthens

Recent analysis has shown interesting shifts among Bitcoin whales during the period of stagnant price action. It is becoming apparent that whales, who hold at least 1,000 BTC (worth a minimum of $29.4 million), are accumulating more Bitcoin. The total number of addresses with a balance of at least 1,000 BTC has increased, indicating increased whale activity. This accumulation by whales is seen by some as a sign that the bull market is returning.

Weekly close clinches key BTC price level

Although Bitcoin’s price action remains range-bound, the weekly close managed to offer a glimmer of hope for those analyzing longer-term trends. Bitcoin closed the weekly candle just above $29,250, a key level that has been highlighted by traders and analysts in recent weeks. This level has historically led to upside moves in BTC price, but the bearish divergence with price on RSI data suggests caution. Several traders and analysts are closely watching BTC’s behavior before the monthly close for more clues about its future direction.

This image is property of s3.cointelegraph.com.

Fed FOMC minutes lead cool macro week

The upcoming week is relatively quiet in terms of macroeconomic data, with the focus primarily on the release of the Federal Open Market Committee (FOMC) minutes. These minutes will provide insight into the attitudes of FOMC members toward interest rate policy when rates were hiked last month. Traders are eagerly awaiting the September FOMC meeting for a potential rate hike pause, which could benefit cryptocurrencies as well. The current odds of a rate hike pause are almost 90%, according to CME Group’s FedWatch Tool.

Bitcoin stays frustratingly quiet after the weekly close

Bitcoin continues to exhibit extremely low volatility, frustrating market observers who are eagerly anticipating a breakout. Despite a tug-of-war between bulls and bears on exchanges, neither party seems able to set a new BTC price trend in motion. Bitcoin’s lack of movement is particularly surprising given the current macroeconomic environment and the potential market catalysts. However, with few macroeconomic triggers in sight, any significant price movement will likely need to come from other sources.

This image is property of s3.cointelegraph.com.

Will the status quo remain this week?

With Bitcoin’s price action stuck in a narrow trading range below $30,000, the question on everyone’s mind is whether the status quo will continue this week. The lack of volatility and clear direction in Bitcoin’s price has left investors and traders frustrated. However, there are signs that a breakout may be imminent, with whales accumulating Bitcoin and volatility indicators suggesting a potential price move in the near future. As the market waits for a catalyst, all eyes will be on Bitcoin to see if it can break free from its current range-bound state.

Bitcoin is giving market observers cause for increasing frustration

Bitcoin’s quietness in the market is causing frustration among market observers. Whether it be on long or short timeframes, the lack of volatility is unprecedented and has led to a lack of clear price direction. Despite the ongoing battle between bulls and bears, neither side has been able to gain control and set a new trend. This frustrating silence is creating tension among traders and investors who are looking for a breakout and some much-needed price action.

This image is property of s3.cointelegraph.com.

Similar conclusion from narrowest volatility recorded for Bitcoin

The lack of volatility in Bitcoin is evident in the narrowing Bollinger Bands, which measure price volatility. The current spread between the upper and lower bands is at its tightest level ever recorded, comparable to levels seen in September 2016 and January 2023. This similarity to previous periods of low volatility has led some market participants to speculate that a big move is on the horizon. While it is unknown whether the breakout will be to the upside or downside, the compressed price range suggests that a significant price movement is imminent.

Knee-jerk BTC price reaction to this week’s data printouts looks unlikely

Despite the release of potentially market-moving data this week, a knee-jerk reaction in Bitcoin’s price is unlikely. Last week’s significant data releases failed to elicit a strong response from the market, suggesting that investors and traders have become accustomed to the lack of volatility. With the focus primarily on the Federal Reserve’s minutes, any significant price movement in Bitcoin will likely be driven by broader market sentiment and the ongoing accumulation by whales. As the market waits for clearer signs, traders should exercise caution and closely monitor the market for any potential breakout.